Case Study: E-Learning Services on Shopping Mall Real Estate Financial Modeling Enhancing Commercial Property Investment Capability

Background on Case Study Shopping Mall-Real Estate-Financial Modeling

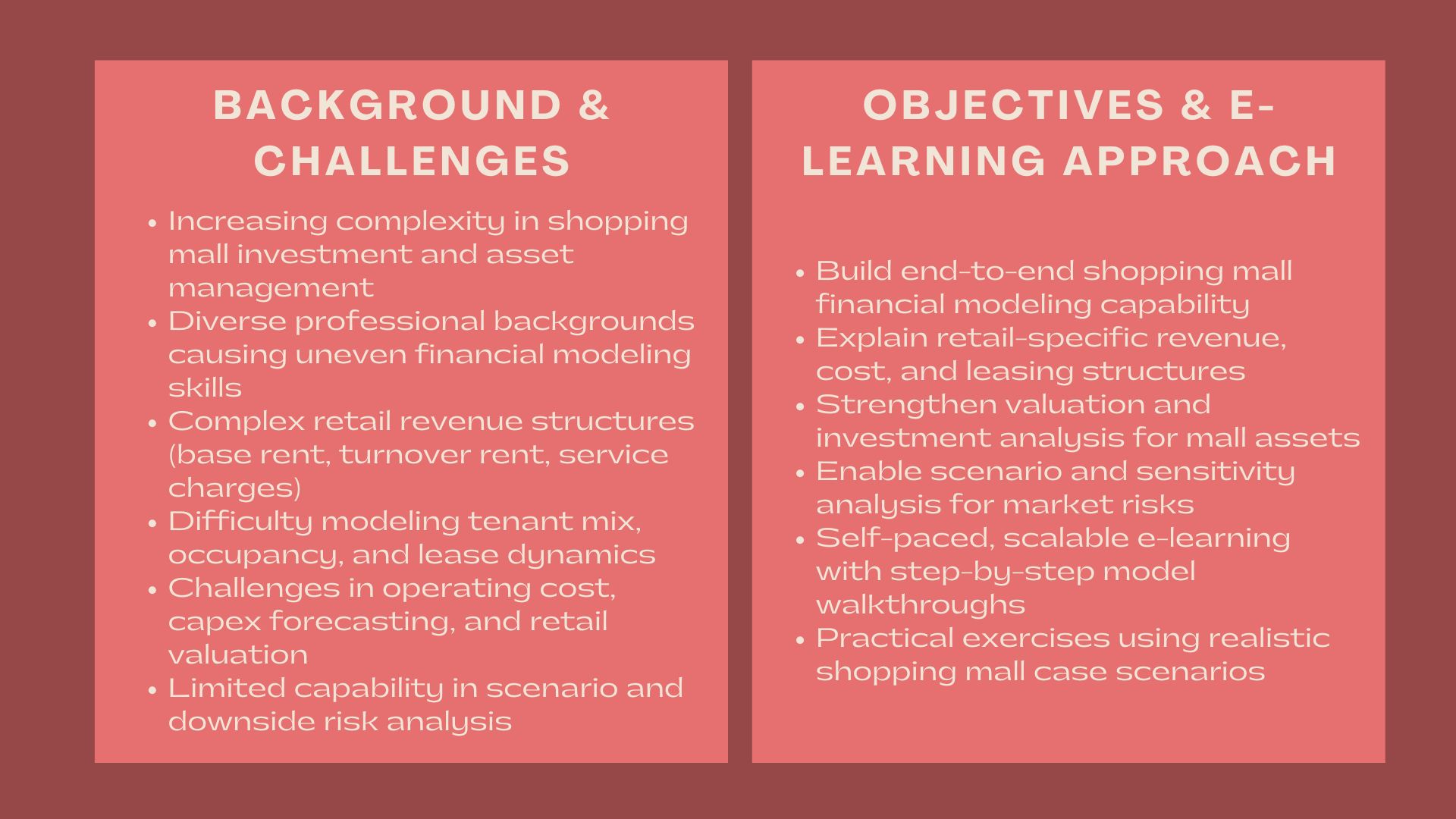

Commercial real estate investment, asset management, and financing professionals are under pressure to come up with complex analyses when appraising shopping malls assets. The dynamic consumer behaviour, changing tenant mixes, and changeable market conditions have increased the pressure on having a powerful financial modelling and scenario analysis.

Financial models are used by many organisations to enable them to make acquisition decisions, redevelopment planning, refinancing and continued management of assets. Yet, the practitioners may have varying backgrounds including leasing, operations, finance, and investment and this creates uneven financial modeling ability when working within the teams.

In response to these issues, our company was contracted to develop and deploy an e-learning course on Shopping Mall Real Estate Financial Modeling whereby the learners would develop practical and industry relevant modeling skills using an adaptable and scalable online learning platform.

Issues and Challenges

There were a number of challenges encountered by the participants that highlighted the necessity of specialised training on real estate financial modelling.

Weak knowledge on shopping mall revenue structures was one of the key challenges. The rental income in the malls is base rent, turnover rent, service charges and promotional contributions that are more complicated compared to the normal office or residential assets.

The other difficulty was in the simulation of tenant mix and occupancy. The modulation of the leasing assumptions, the vacancy rates, lease termination dates and escalation of rent necessitated a systematic model design.

There were also problems operating cost and capital expenditure forecasting. The shopping malls are expensive to operate, renovate, and at times introduce new capital to stay in the market.

Another issue ticked valuation complexity. Students had difficulty in implementing income-based valuation techniques, terminal value models and discount rates that were suitable to retail assets.

Lastly, the exposure of many professionals to scenario and sensitivity analysis was restricted, and they could not estimate downside risks of decreasing footfall, churning of tenants or economic factors.

Objectives

The main aim of the engagement was to come up with an e-learning programme on Shopping Mall Real Estate Financial Modeling that could systematically establish modeling and valuation capacity.

Key objectives included:

- End to end shopping mall financial modeling.

- Retail-specific revenue and cost structure explanation.

- Increasing the skill of valuation and investment analysis.

- Enhancing the ability to do scenario and sensitivity analysis.

- Provision of self-paced learning that is flexible to a wide range of learners.

The programme should have been realistic and practical, and applied to real-life investment and asset management decision making.

How We Helped

A systematic instructional design style was used to develop a holistic shopping mall real estate financial modeling e-learning programme.

The interaction started with curriculum development. We have developed a rational learning flow beginning with the real estate foundations and advancing through advanced shopping mall methods of modeling.

The initial modules exposed the learners to the nature of the business model in shopping malls, the nature of assets and the driver of income. We discussed the leasing arrangement, types of tenants and types of revenue that are peculiar to retail properties.

The programme itself was based on the creation of a financial model of the shopping mall in stages. Learners were taken through:

- Organizing model assumptions and schedules.

- Predicting the rental revenues per tenant.

- Occupancy, lease renewals and escalations modeling.

- There is the estimation of operating expenses and recoverable costs.

- Adding the capital expenditure and refurbishment cycles.

We then presented shopping mall-specific valuation techniques. Discounted cash flow (DCF) valuation, estimation of terminal value, and valuation that is based on yields were discussed.

Scenario analysis and sensitivity analysis were incorporated during the course. Students investigated the impact on the asset value and returns of alterations in the occupancy rates, growth in rentals, operating expenses, and exit yields.

The programme incorporated practical modeling exercises involving realistic shopping mall case scenarios in order to increase practical understanding. The learners would be able to participate in guided walkthroughs and practice in the e-learning environment by themselves.

Everything was presented using a user-friendly e-learning system, and the students could learn at their own speed. Different styles of learning were supported by video explanations, downloadable templates and reference materials.

Learning Design and Delivery

The e-learning programme was dynamic and adaptable such that learners were given an opportunity to concentrate in areas that best suited their jobs.

Interactive lessons were a combination of theoretical explanations and practical demonstrations of the modeling. Learning was reinforced with knowledge checks and real life training exercises.

Self-paced nature allowed making the programme applicable both to individual learners and training deployments in corporations, allowing organisations to train teams up without interfering with their daily work.

Value Delivered

As demonstrated in this case study, commercial real estate investment and asset management capability can be enhanced by E-Learning Services on Shopping Mall Real Estate Financial Modeling.

The programme combined with systematic education with close retail-specific modeling activities allowed learners to comprehend the economics of shopping malls better, evaluate the risks of investing in shopping malls and inform decision making.

The scalable learning system is sustainable in the long-term due to the continuous skill enhancement as the retail property markets evolve.