Corporate Valuation Training in Kuala Lumpur – Riverstone Training

Introduction to Advanced Corporate Valuation Kuala Lumpur

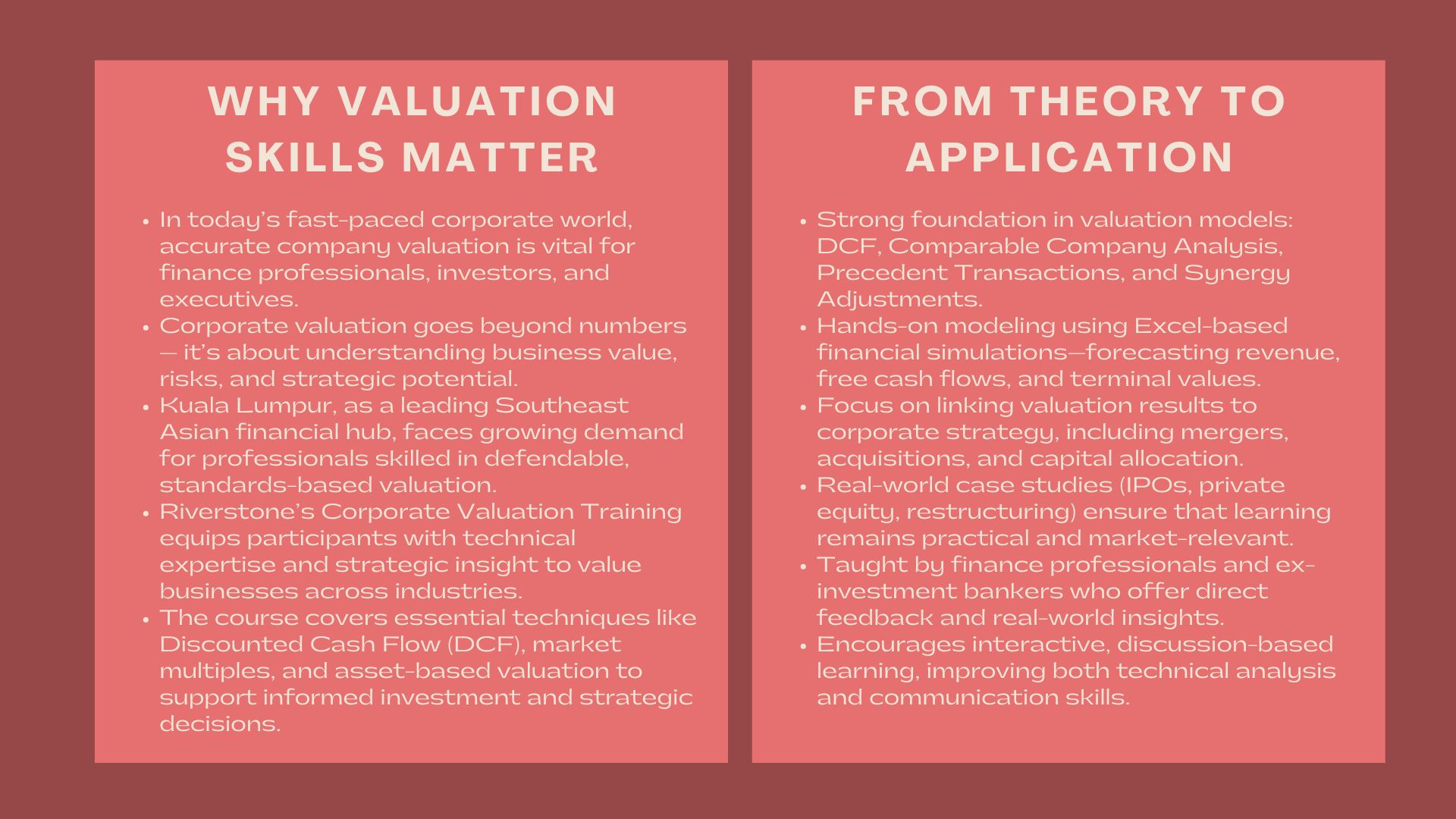

In the present business environment that is very fast-paced and corporate, the skill of effectively establishing the true value of a company has become an essential competence among finance employees, investors, and the top management of companies. It is not just a number game in corporate valuation, but it is more about how business build value, risk management and strategic decision-making in dynamic markets.

Kuala Lumpur is one of the financial centres in Southeast Asia and has experienced the growth of demand of people who may carry out accurate, defendable valuation that is congruent with international standards. Riverstone Training is therefore responding to this need by creating a complete Corporate Valuation Training Program in Kuala Lumpur, which trainers will help provide the professional with the technical and strategic skills to knowledgeably value businesses in any industry.

Corporate Valuation and its Significance in the Contemporary Business.

Learning the essence of Business Value.

Business valuation rests on the corporate finance, mergers and acquisitions (M&A), investment analysis, and financial reporting. It could be a startup that needs to be financed, a corporation that needs to find an acquisition partner or an investor that needs to understand the equity possibilities, but valuation expertise is the foundation of good decision-making.

Riverstone’s business valuation courses in KL delve into both the theoretical foundations and the practical techniques of valuation. The participants learn how to apply such methods as Discounted Cash Flow (DCF) analysis, Market multiples and asset-based techniques in addition to understanding how assumptions, industry conditions and financial performance can be applied in determining valuation outcomes.

Strategic Decision-Making Tool: The use of valuation.

Besides the figures, valuation is also a highly significant element of strategic business planning. Good valuation will provide us with a clue of the current status of the company and the possible status in future. It guides leaders as per capital allocation, business re-organization, fund raising and shareholders negotiation.

The Riverstone program includes the use of real-life cases that can help the participants to realize the effects of valuation findings to the process of mergers, investment strategy and boardroom decisions. The course will transform valuation into a more managerial instrument of corporate growth and investor confidence.

Within Corporate Valuation Program of Riverstone.

The Solid Foundation in Valuation Theory Building.

The core of the program is a profound knowledge of valuation models and their application in business situations. Researchers research fundamental methodologies such as:

- Sensitivity testing and a Discounted Cash Flow (DCF) analysis.

- Similar company analysis (Comps) and past deals.

- Enterprise vs. equity The differences in enterprise and equity valuation.

- Control premiums, minority interests and synergies adjustments.

Riverstone Corporate Valuation Training makes sure that participants are able to utilize and interpret such models correctly and know their weaknesses. The course helps in bridging the divide between theoretical and practical knowledge with both analytical rigor and practical good judgment that is stressed.

Practical Valuation Modeling and Financial Analysis

Hands-on learning is at the center of Riverstone’s approach. Through the advanced corporate valuation in KL program, participants build and refine Excel-based financial models that simulate real-world scenarios.

They get to know how to predict revenues, compute free cash flows and terminal values and make adjustments that take into consideration the inflation, growth assumptions, and risk factors. The experience in this modeling makes people prepared to make quality and justifiable valuations, which is crucial when working in investment banking, equity research and corporate finance.

Valuation is to be combined with Corporate Strategy.

One of the peculiarities of the program developed by Riverstone is the emphasis on the strategic side of the valuation. Participants are taught to relate the results of valuation to bigger business strategies, e.g. expansion strategies, joint ventures, or divestitures.

The training is aimed at creating a strategic attitude in the professionals, i.e. valuation is not regarded as a separated process but a part of combined financial strategy. This holism approach enables participants to provide actionable (rather than analytic) insights.

Who will be the beneficiaries of this training.

Financial, Investment and Advisory Professionals.

The Corporate Valuation Training will be customized to suit the participants of the financial, investment, and advisory service industry, including analysts, consultants, and portfolio managers. The professional valuation workshops in KL empower them with frameworks and tools to evaluate investment opportunities, conduct due diligence, and prepare valuation reports that meet professional standards.

The participants become confident enough to present the analysis before the investors, clients, and auditors, improving their professionalism and career development.

Corporate CEOs and Businesspersons.

The program is also useful among business owners, CFOs and corporate executives who are in the decision making process. Valuation would help them to negotiate well, evaluate acquisition proposals and develop strategies to boost the shareholder value.

The course is also valuable to entrepreneurs and SME owners in having a better understanding of how investors perceive their companies- to help them solidify business models and prepare to make sustainable growth or exits.

A Unique Learning Process with Riverstone.

Practical Learning using Real Case studies.

The method of teaching at Riverstone is not restricted to textbooks and formulae. The case studies are based on real business deals and valuation issues. These are illustrations of how market forces, governance and business performance determine valuation outcome.

The participants can gain skills to use valuation frameworks in different and changing business settings by learning to analyze real life situations, including IPO pricing, private equity transactions, and restructuring valuations.

Professional Teachers who have worked in the industry.

Riverstone teachers are all finance-based professionals who have significant experience in corporate valuation, investment banking and financial consulting. Their pragmatic knowledge makes sure that the participants develop a practical knowledge on the valuation practices in the contemporary corporate environment.

Professors give individual feedback on models, lead discussions over complicated cases and exchange the best practices in generating transparent, justifiable valuation products-competencies vital to people in competitive finance positions.

Collaborative Learning Environment and Interactive.

Riverstone Training is a very interactive and discussion-oriented environment that encourages a learning process through the instructors and the peers. Group activities and break out will promote teamwork where professionals in other fields will share their views and also develop networks.

The interactive style of learning design will ensure that the participants are not only able to gain technical knowledge but also develop communication and presentation skills needed during valuation jobs.

The Benefits of Mastering Corporate Valuation in the Career.

Expanding Career Horizons

Financial analysts who are able to conduct sound valuations are in demand in the modern day finance industry, be it in investment banking, or corporate finance and even in private equity. The Corporate Valuation Training in Kuala Lumpur offered by Riverstone prepares the participants to enter into positions of greater value where decision-making is concerned with related strategic finance.

Be it in being a valuation expert, corporate strategy consultant or even M&A consultant, the course offers the platform to enable one seek various opportunities both locally and internationally in the market.

Improving Professional Recognition.

Riverstone program recipients are awarded a Certificate of Achievement, which is a qualification that indicates competence and willingness to develop professionally. Such recognition assists the participants to stand out in the competitive and competitive job market in finance and illustrates that they are capable of providing sophisticated analyses of valuation that can fit with the global standard.

Networking with a Professional Network.

Riverstone training also exposes one to a pool of fellow professionals and industry players. The links established in workshops are frequently reported by the participants to generate collaborative opportunities, career development, and further professional development even after the course has ended.

Conclusion: Advanced Corporate Valuation Kuala Lumpur

The core of corporate finance is valuation, which determines perceptions of business performance and potential by investors, executives, and other stakeholders. A business in a dynamic market such as Kuala Lumpur requires the services of professionals who are well equipped with highly advanced valuation skills who can provide good investment and strategic decisions.

Corporate Valuation Program at Riverstone Training in Kuala Lumpur equips the participants with the ability to balance technical mastery and strategic insight. With real-world modeling, expert training and practical case studies combined, Riverstone enables finance professionals to discover their potential – and valuation be more of a calculation and competitive edge.