The Magic Formula of Inventory Valuation

What is Inventory Valuation?

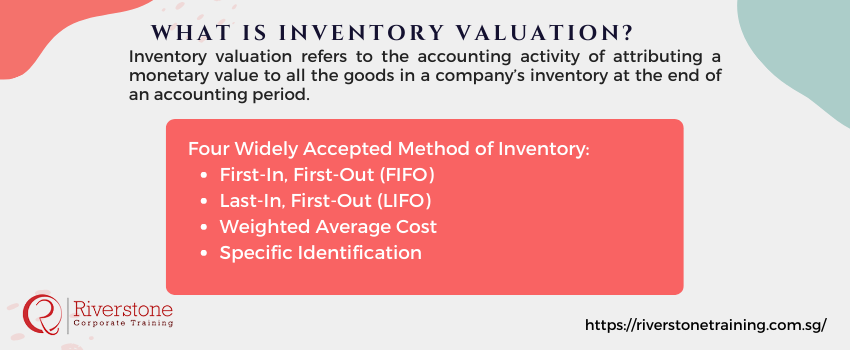

Inventory valuation refers to the accounting activity of attributing a monetary value to all the goods in a company’s inventory at the end of an accounting period. In simple terms, it means determining how much is the worth of all the goods in a company’s inventories. The final number resulting from the valuation includes all the costs incurred while purchasing or manufacturing the inventory and getting it ready for sale. Since inventory is a major line item in reporting, understanding it is essential when analyzing the components of a basic financial statement.

The value of a company’s inventory appears on its balance sheet. For many businesses, inventories are their most significant asset and their value plays a crucial part in the company’s ultimate profitability. Calculating the cost of goods sold and determining the company’s bottom line is impossible without first doing an inventory valuation. Once the value is specified, companies can also use their inventory valuation as collateral for loans if it is of sufficient amount and not obsolete in any way. For those new to financial reporting, an understanding a balance sheet components guide can help clarify where inventory fits and how it impacts a company’s overall financial health.

The four widely accepted methods of inventory valuation are:

- First-In, First-Out (FIFO)

- Last-In, First-Out (LIFO)

- Weighted Average Cost

- Specific Identification

First-In, First-Out (FIFO) Method in Inventory Valuation

FIFO based on the assumption that the first items to enter the inventory are also the first ones that sold. The unsold items in the inventory valuation are value matched to the things that most recently manufactured or purchased. For example, let’s imagine a factory produces 1000 pairs of socks in January at the cost of $5 per pair, and 1000 more pairs in February at $6 per pair.

According to FIFO, if the company sells 1000 pairs in March, the cost of goods sold (COGS) on the income statement will be $5 per pair. January inventory valuation was used because $5 was the cost of the pairs that first entered the inventory. The $6 pairs of socks will end up in the ending inventory.

FIFO often used because it is simple and easily understandable. The FIFO method has a significant drawback during times of high inflation when it fails to depict costs accurately. When prices are increasing FIFO will generate higher values of the ending inventory and a lower cost of goods sold. This results in a falsely higher gross profit in times of rapid inflation.

Last-In, First-Out (LIFO) Method in Inventory Valuation

The assumption under LIFO is that the last units arriving into inventory will be the first ones sold. Old inventory remains. This method is used less often than FIFO since old inventory is harder to sell. The values from LIFO will result in lower company profitability. If we remember our imaginary sock manufacturing factory, with LIFO the $5 sock pairs will constitute the ending inventory while the $6 pairs used to calculate COGS. LIFO does have tax advantages during inflation, as lower profitability means companies pay less tax. To apply LIFO accurately, understanding how to calculate COGM step-by-step is essential, as it ensures that production costs are properly aligned with inventory flow and financial reporting.

Weighted Average Cost Method in Inventory Valuation

This method takes the average value of all units ready for sale and, based on that, determines the value of the inventory and COGS. This method most commonly used by businesses that manufacture or sell products that are difficult to track and are indistinguishable from one another (bread, bolts, mortar, etc.) Understanding cost drivers in manufacturing finance is essential when applying this method, as it helps identify the underlying factors influencing production costs and ensures accurate inventory valuation.

Specific Identification Method in Inventory Valuation

This method is opposite of the Weighted average cost and only used for high-value items with features that distinguish them from one another (high-end machines, made to order industrial vehicles, etc.). The Specific identification method can not be put into practice unless every item is tracked individually with a serial number, an RFID tag or by some other valid means.

Inventory Valuation in Singapore: Why FIFO and Weighted Average Reign (and why LIFO is out)

While global accounting practices present various inventory valuation methods, businesses in Singapore must adhere to Singapore Financial Reporting Standards (SFRS), which are largely aligned with IFRS. This means LIFO (Last-In, First-Out) is strictly not permitted. This article would explain why FIFO (First-In, First-Out) and the Weighted Average Cost methods are the primary choices for Singaporean companies. We’ll delve into the regulatory reasons behind this, provide clear examples of how these two methods are applied, and discuss their specific impacts on your financial statements and tax obligations in Singapore. To understand how inventory valuation influences your business’s overall worth, explore this guide to company valuation in Singapore.

Beyond Calculation: Strategic Implications of Your Inventory Valuation Method on Profitability and Cash Flow

Choosing an inventory valuation method isn’t just an accounting formality; it’s a strategic decision that profoundly impacts your business’s reported profitability and cash flow. This article would move beyond the mechanics to explore the real-world implications of using FIFO versus Weighted Average Cost. We’ll illustrate how your chosen method influences your Cost of Goods Sold (COGS), ultimately affecting your gross profit and taxable income. Understand how businesses in Singapore can strategically select a method that not only ensures compliance but also optimizes financial reporting to reflect true business performance and support decision-making. To understand how valuation methods influence overall company worth, consider exploring the best business valuation course in Singapore.