How Does It Works, Definition, and Types of Loans

The process can be complicated and cumbersome when it comes to large-scale financing projects. The world of project finance is filled with different types of loans and varying definitions. It can be difficult to navigate, especially for those who are just beginning. In this post, we will go over project finance: how it works, its definition, and the various types of loans used in the industry. We’ll also look at some successful financing projects and discuss the benefits of using project finance for your business needs.

What is Project Finance?

“Project finance is a financing method that offers long-term funding for infrastructure and capital-intensive projects, usually based on a public-private partnership (PPP) or similar arrangement. Professionals seeking to master its application may consider enrolling in the best project finance course.

Project finance is distinct from corporate finance in that it focuses on financing specific projects rather than on the general financial needs of a business. This means that project finance deals with the allocation of risk and rewards associated with a project rather than with the overall financial position of a company.

Several types of project finance loans can be broadly divided into two categories: senior debt and mezzanine debt. Senior debt is typically provided by banks and other institutional lenders, while private equity firms and other investors usually provide mezzanine debt.

Project finance can fund many projects, including new build developments, refurbishments, acquisitions, mergers & acquisitions (M&A), and leveraged buyouts (LBOs). It can also be used for brownfield projects, which are redevelopment or expansion projects on existing sites. Professionals seeking to deepen their understanding of such complex transactions may benefit from enrolling in the best mergers and acquisition course for professionals or complementing their expertise with an advanced finance course for working professionals.

What Are the Risks of Project Finance?

Potential borrowers should be aware of a few risks associated with project finance before taking on a loan. First, since project finance loans are typically large and long-term, there is a greater risk of default. If borrowers cannot make their loan payments, the lender may foreclose on the project and recoup their losses. There is also a higher interest rate associated with project finance loans, which means borrowers will have to pay more in interest over the life of the loan. Additionally, many project finance loans are non-recourse, meaning that if the borrower defaults or failed to pay, the lender can only go after the collateral pledged against the loan (usually the project itself). This means that borrowers may have to give up ownership of their project if they can’t repay their loan.

How does project finance works

Project finance is a type of financing used to fund capital-intensive projects. Project finance is typically used to fund new infrastructure or facilities, such as power plants, railways, and dams.

Project finance is a form of limited-recourse financing, meaning that the lenders do not have recourse to the borrower’s whole other assets in the event of default. This type of financing is often used for large, risky projects where the lender’s risk is mitigated by the fact that they are only exposed to the collateral associated with the project.

Project loans are typically repaid through the revenue generated by the project itself. This means that project finance is a long-term form of financing and can be somewhat illiquid. To secure project financing, borrowers often need to provide lenders with a detailed business plan and financial projections for the project.

There are several types of project finance loans, including:

-Bridge Loans: Bridge loans are short-term loans used to finance the construction of a new project until longer-term financing can be secured. Bridge loans are typically interest-only loans, meaning that only interest payments are required during construction.

-Construction Loans: Construction loans are short-term loans used to finance a new project’s construction. Construction loans typically have a term of one year or less and require periodic interest payments during the construction period.

-Mezzanine

The Different Types of Project Finance Loans

Project finance is a method of financing in which one or more loans fund a project. The project assets, such as equipment, land, or buildings, typically secure the loans. Project finance can be used to finance a wide variety of projects, including construction projects, mining projects, and manufacturing projects.

There are several different types of project finance loans. The most common type of loan is the construction loan. Construction loans are typically used to finance the construction of a new factory, office building, or another type of commercial property. Construction loans are typically short-term loans with terms of one to three years.

Another type of project finance loan is the mezzanine loan. Mezzanine loans are subordinate to senior debt and equity interests in a project. Mezzanine lenders typically require personal guarantees from the owners of the project. Mezzanine loans are typically used to finance small- to medium-sized projects.

A third type of project finance loan is the bridge loan. Bridge loans are short-term loans that bridge the gap between completing a project and receiving long-term financing. Bridge loans are typically used to finance larger projects.

Project finance can be an attractive option for businesses seeking financing for their projects. Project financing can give businesses access to the capital they would not otherwise have access to. Project financing can also help businesses reduce their exposure to risk by spreading the risks among multiple lenders.

How to Get a Project Finance Loan

When financing a large project, many companies turn to project finance loans. But what is a project finance loan? And how can your company get one?

A project finance loan is a type of loan that is specifically used to finance a large project. The loan is typically used to cover the construction, equipment, and other expenses associated with the project.

To qualify for a project finance loan, your company must have a strong financial history and a good credit rating. The lender will also want a detailed business plan for the project.

If your company is interested in getting a project finance loan, there are a few things you can do in order to improve your chances of getting approved:

- Make sure you have a strong financial history and a good credit rating.

- Put together a detailed business plan for the project.

- Find a reputable lender who specializes in project finance loans.

Pros and Cons of Project Finance

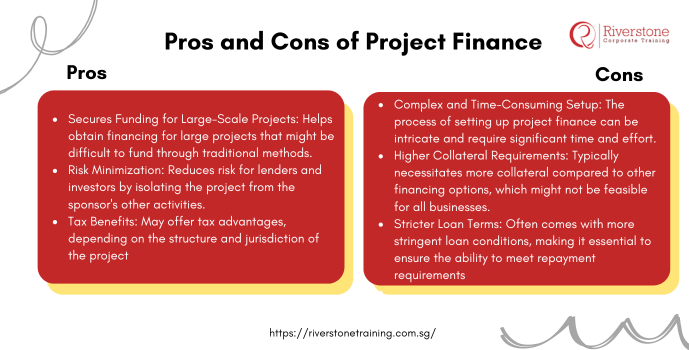

There are many benefits to pursuing project finance. One advantage is that it can help to secure funding for large-scale projects that may be difficult to finance through traditional methods. Project finance can also help minimize risk for lenders and investors and provide tax benefits in some cases.

However, there are also some drawbacks or disadvantages to consider before pursuing project finance. One potential downside is that setting up can be complex and time-consuming. Additionally, project finance typically requires a higher level of collateral than other types of financing, which may not be feasible for all businesses. Finally, loan terms for project finance can be stricter than other types of loans, so it’s important to be sure you can meet the repayment requirements before taking on this type of debt.

The Differences Project Finance and Corporate Finance in Large Investments

When investing big amounts of finance, it is important to learn the difference between the project finance and corporate finance. Corporate finance has a general financing of the overall operation of a company with the lenders being given the right of recourse on all the assets of the company. Conversely, project finance is a limited recourse system where funding is lent on the back of a certain stand alone limited project assets and future cash flow. Project finance lenders do not look at the parent company balance sheet to make repayments, and instead, they majorly consider the revenues on the project. This difference leads to differences in the distribution of risk, requirements of collateral and intricacies by the financing structure and hence project finance is most suitable when the venture is type capital intensive infrastructure or energy. To fully grasp these distinctions and their implications, professionals may benefit from enrolling in a project finance modeling course Singapore or a professional finance training course Singapore. For those with demanding schedules, a project finance course for working professionals or a flexible project finance e-learning course 2025 can offer the convenience of online, self-paced learning.

Alternatives to Project Finance

Companies can consider a few alternatives to project finance when looking to fund their next big project. The first is corporate finance, the traditional way of funding a business through equity or debt. This option is typically more expensive than project finance, but it may be the only option for some businesses. The second alternative is government loans, which are often cheaper than private loans but can have more restrictions. Finally, some venture capitalists may be willing to invest in a high-risk project if they believe it has the potential for high returns.